UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the Fiscal Year Ended

OR

(Exact name of registrant as specified in its charter)

| (State of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

(Address of principal executive offices) (Zip code)

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name on Each Exchange on Which Registered | ||

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “small reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | Emerging growth company | ||

| Accelerated filer | ☐ | Smaller reporting company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. Yes ☐ No

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of June 30, 2023, the aggregate market value

of the registrant’s Common Stock held by non-affiliates of the registrant was $

The number of shares outstanding of the registrant’s Common Stock,

$0.001 par value, was

TABLE OF CONTENTS

i

Note Regarding Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s beliefs and assumptions and on information currently available to management. Some of the statements in the section captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Description of Business,” and elsewhere in this annual report contain forward-looking statements. In some cases, you can identify these statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expects,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of these terms or other comparable expressions that convey uncertainty of future events or outcomes, although not all forward-looking statements contain these terms.

These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Forward-looking statements in this annual report include, but are not limited to, statements about:

| ● | our estimates regarding expenses, future revenue, capital requirements and liquidity; |

| ● | our plans to obtain any requisite outside funding for our current and proposed operations and potential acquisition and expansion efforts; |

| ● | the success of the Company’s plan for growth, both internally and through pursuit of suitable acquisition candidates; |

| ● | the concentration of our customers and the potential effect of the loss of a significant customer; |

| ● | debt obligations arising from our line of credit or otherwise; |

| ● | our ability to integrate the business operations of businesses that we acquire from time to time; |

| ● | the possibility that we may be adversely affected by other economic, business or competitive factors including market volatility, inflation, increases in interest rates, supply chain interruptions, and may not be able to manage other risks and uncertainties; |

| ● | our ability to compete with companies producing similar products and services; |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our products and technology; |

| ● | the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| ● | our ability to develop and maintain our corporate infrastructure, including our internal controls; |

| ● | our ability to develop innovative new products and services; and |

| ● | our financial performance. |

ii

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Overview

DecisionPoint Systems, Inc. (“DecisionPoint”, the “Company”, “we” or “us”) was originally organized in August 2010 under the laws of the Province of Ontario and subsequently filed a Certificate of Corporate Domestication with the State of Delaware on June 14, 2011.

The Company, through its subsidiaries, consults, designs, and implements mobility-first enterprise solutions, retail solutions centered on Point-of-Sale systems and services that support our customer’s operations. DecisionPoint provides managed and professional services that better enable our customers to implement and manage complex projects on time and on budget. Our products and services are intended to help our clients improve their operations and drive greater productivity. DecisionPoint partners with hardware, software and services companies to combine enterprise-grade handheld computers, printers, tablets, smart phones and retail POS into solutions aimed to improve productivity, provide greater levels of customer services, allowing our customers to be more competitive. DecisionPoint leverages its software and services portfolio including our Mobile Conductor Platform which provides a “Direct Store Delivery” (DSD) solution to the wholesale distribution market via our proof-of-delivery and route accounting applications. Our ViziTrace Platform provides our customers with the ability to integrate radio frequency identification (“RFID”) technology’s into existing workflows, making them more efficient and effective in the marketplace. Our Managed Services and Managed Mobile Service offerings provide our customers a way to implement, manage, monitor, and maintain all these technologies for the lifetime of the implementation, while supporting and augmenting our customer’s IT teams.

Acquisitions have been an important element of our growth strategy and are expected to be in the future. We have supplemented our organic growth by identifying, acquiring and integrating businesses that results in broader, more sophisticated product offerings, while diversifying and expanding our customer base and markets. In 2018, we acquired Royce Digital Systems, Inc. (“RDS”), a provider of innovative enterprise solutions. RDS has expanded our product portfolio with mission critical printers, consumables and custom labels and a wide array of on-site professional services. Additionally, RDS has provided new opportunities in the healthcare sector which is incremental to our existing markets of Retail and Logistics. In December 2020, we acquired ExtenData Solutions, LLC (“ExtenData”), an enterprise mobility solutions provider headquartered in the Denver metropolitan area. ExtenData’s products and services are synergistic and complimentary to those provided by the Company. The ExtenData acquisition was intended to enhance and supplement the products and services offered by the Company and broaden our customer base. In January 2022, we acquired Advanced Mobile Group, LLC (“AMG”), a company that brings skills in voice directed technologies and RFID via the ViziTrace Platform. In April 2023, we acquired Macro Integration Services, Inc. (“Macro”), a project management and professional services and integrated solutions company.

Background – Products and Services

DecisionPoint delivers mobility-first managed service and integration solutions to healthcare, supply chain, and retail customers, enabling them to make better and faster decisions in the moments that matter—the decision points. Our mission is to help businesses consistently deliver on those moments—accelerating growth, improving worker productivity, and lowering risks and costs.

DecisionPoint’s products and services are intended to empower mobile workers through the implementation of various mobile technologies including specialized mobile business applications, wireless networks, mobile computers and a variety of consumer and mobile computing devices. We also provide a comprehensive managed services portfolio that includes consulting, integration, project management, software development, deployment, and life cycle management services. Those services include configuration, repair services, help desk, and implementation services helping our enterprise customers operationalize their mobile investments. We also provide deployment and installation services into the retail POS marketplace.

At DecisionPoint, we deliver to our customers solutions that enable them to make better, faster and more accurate business decisions by implementing industry-specific, enterprise grade wireless, scanning, RFID and mobile computing systems for their front-line mobile workers, inside and outside of the traditional workplace. Our solutions are designed to unlock mission critical information and deliver it to employees, at the point of activity, when needed, regardless of their location. As a result, our customers are able to move their business decision points closer to their customers: improving customer service levels, reducing costs and accelerating business growth.

Mobility solutions and usage, in general, continue to grow and change rapidly. Many companies are leveraging mobile solutions to deliver information to their associates and customers in new and innovative ways that create competitive differentiation. Rapid change and innovation lead to increasingly complex solutions and requirements. Internal IT staff can be overwhelmed by the complexity of managing and operationalizing these mobile solutions. DecisionPoint seeks to eliminate this complexity through our managed services offerings to allow our customers to focus their resources on business transformation and bottom-line results.

1

A comprehensive mobile solution requires close coordination with many suppliers such as Original Equipment Manufacturers (“OEMs”) manufacturers, carriers, security organizations, software providers and others.

We have developed an ‘ecosystem’ of partners to support the assembly and manufacturing provisions of our custom and off-the-shelf solutions, including handheld device manufacturers, independent software vendors and wireless carriers.

DecisionPoint has offices throughout North America with service centers located on both the East and West Coast allowing us to serve multi-location clients and their mobile workforces.

Our Markets and Primary Customer Industries

DecisionPoint is a mobile systems integrator providing enterprise mobility solutions to the retail, logistics and healthcare markets. These solutions span the complete technology life cycle from systems design and implementation capabilities to a complete portfolio of support services including repair center services and managed mobile services.

During 2022 we developed a new portal, VISION. VISION is intended to offer our customers a customizable solution for monitoring actions on everything in their IT infrastructure. Decisionpoint can manage the entire lifecycle of Mobility and IT infrastructure all in one view. VISION provides real-time visibility to manage the health, location, and status of mission-critical IT assets; VISION also enables clients to monitor the progress in major rollouts. This enables our customers to minimize downtime and simplifying the management of a large, distributed enterprise.

VISION is intended to allow customers to:

| ● | Track assets by location and health status via an interactive map; |

| ● | Monitor servers, switches, PC’s, and POS systems; |

| ● | Deploy custom configured Mobile Devices and the surrounding Infrastructure; |

| ● | Engage in custom asset tagging; |

| ● | Engage in RMA creation with advanced exchange management |

| ● | Monitor and effect repair and refurbishment of assets |

Retail In-Store Operations

We assist retail customers in selecting and procuring the correct mobile and POS technology, deploying and installing it and managing that technology for its entire life cycle. Our VISION portal and OnPoint asset management system helps our retail customers with distributed stores and networks manage support, repairs, returns and every facet of the life of their POS systems and mobile devices. This allows our customers’ IT resources to be leveraged for competitive advantage as we take care of this critical function.

Warehousing and Distribution

DecisionPoint provides products and services to large retailers, warehouses and third-party logistics providers to ensure their logistics operations are modern, efficient and provides them with a competitive advantage. We work closely with our customers to select the right technology in a rapidly changing world intended to give them return on investment throughout its lifetime of deployment. Applications such as Yard Management, Receiving, Picking, Hands-Free, and Voice are all components of a system that provide value. DecisionPoint assists our customers to manage the largest of projects with flawless execution along with the lifecycle management services that keep those IT assets operational.

Healthcare

Through the acquisition of RDS in 2018, DecisionPoint expanded its presence in healthcare. RDS has provided hardware, integration, IT Services, and a myriad of healthcare solutions to one of the largest systems in the country for 25+ years supporting clinical workflows throughout the healthcare systems. DecisionPoint currently provides service on-site for more than 30,000 IT assets, such as Barcode printers and scanners. That expertise combined with our account base of healthcare systems and healthcare manufacturing makes this vertical our second largest vertical as of December 31, 2023.

Wholesale Distribution

Through the acquisition of ExtenData, DecisionPoint added to its portfolio of reoccurring revenue with the MobileConductor (MC) software platform. MC is application software sold into the Direct Store Delivery (DSD) and Proof of Delivery (POD) marketplace in a SaaS model. MobileConductor enables us to provide complete in-vehicle solutions inclusive of hardware and services.

2

Field Sales and Service

DecisionPoint has and expects to roll-out a new tablet system for field representatives of large enterprise customers. DecisionPoint co-developed the software hand-in-hand with its customers operations team that is intended to improve the efficiencies of customer field representatives and make it easier for them to record deliveries, pick-ups and transact sales on the spot. This tablet system has been a multi-year project, which continues to evolve and improve our customer’s competitive position.

The field sales and service market is experiencing significant growth. This space has evolved and moved from rugged to consumer technologies in many instances. As a result, DecisionPoint intends to leverage our experience to expand our offerings and options for our customers as the technology changes and evolves. DecisionPoint intends to provide its complete line of services, including custom or packaged software solutions to these markets, representing another area of potential growth.

Services

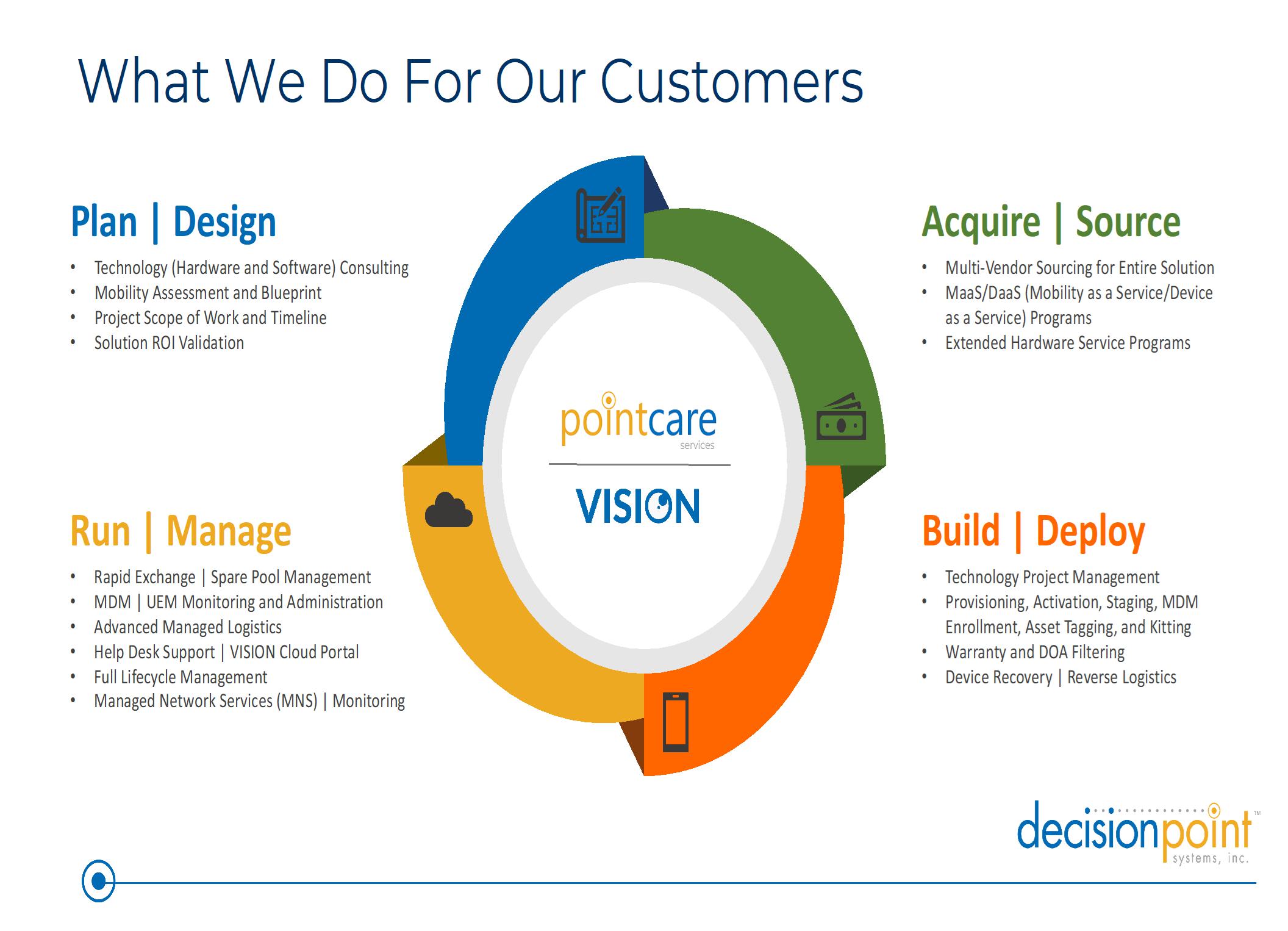

Pointcare

In early 2024, DPS announced our new PointCare Services—a premier suite of deployment and managed services built to address all aspects of selecting, deploying, and managing enterprise technology.

All prior DecisionPoint Services have been fully integrated into the PointCare suite of services so all customers will benefit from the enhanced services programs that are available today. PointCare is also fully integrated with our Vision portal allowing for complete visibility of your assets covered under a PointCare contract.

PointCare allows us to handle all aspects of a customer’s complex technology deployment so they can focus on their business. Our consultative approach allows us to blueprint, prescribe, and deliver the services our customers need to deploy and sustain their mission critical Enterprise Mobility, Point of Sale, and RFID technology.

PointCare was specifically created to address every aspect needed to design, deploy, and manage the entire ecosystem around the technologies we provide. We’ve leveraged our extensive expertise in Mobility, Point of Sale, and RFID deployments to create an end-to-end service program that’s simple to incorporate into our customer’s processes.

Lifecycle Management

As part of our services, DecisionPoint, helps customers maximize the life of their IT assets. When OEMs discontinue a product or provide poor service on an aging product it can force our customers into an upgrade, they may not be ready to manage or afford. We work closely with our customers in all verticals to attempt to provide them extra value at the end of an asset’s lifecycle.

Deployment and Project Management

Project management and deployment services are also an area of focus for the Company. DecisionPoint’s project management team has handled nationwide retail point of sale deployments and a myriad of other projects that augment customer IT teams. The same applies to healthcare where we have the expertise to understand clinical workflows and how an IT implementation needs to be executed.

Managed Services

DecisionPoint offers a comprehensive product portfolio of managed services designed to simplify the complexity associated with designing, deploying and managing a mobile solution. Each product service is defined by specific deliverables and reporting requirements.

The product portfolio includes:

| ● | Consulting – Solution Design & Business Process Review | |

| ● | Technology Acquisition | |

| ● | Project Management | |

| ● | Software Integration and Development |

3

| ● | Deployment (depot and on-site) | |

| ● | Repair Services (depot and on-site) | |

| ● | Service Desk (tier 2 technical support | |

| ● | Rex – Rapid Exchange Services | |

| ● | OnPoint Services Hub (24x7x365 Asset Management Portal) |

Customers can acquire our product service SKU’s a-la-carte or in a complete services bundle.

Customers receive real-time asset management and tracking information through DecisionPoint’s OnPoint™ Service Hub, an internally created customer service portal that provides our customers with a 24/7 view of their technology assets being managed by DecisionPoint.

4

As a Service

DecisionPoint also offers “as a service models” that include devices, services, software and consulting in one monthly recurring charge.

Software

The market for enterprise mobile software is generally specialized. Enterprise mobile software systems must support industry-specific and customer-specific business processes. For this reason, we utilize several avenues to provide mobile software solutions to meet our customers’ unique requirements, including:

| ● | Software as a Service: SaaS is a core strategy to grow our recurring revenue base. In 2020, DecisionPoint acquired ExtenData’s MobileConductor™ , a software platform targeted at the Direct Store Delivery (DSD) and the Proof of Delivery (POD) markets. In 2022, DecisionPoint acquired Advanced Mobile Group’s VizeTrace™ , a software platform that manages RFID installations. Both MobileConductor and ViziTrace are owned platforms of DecisionPoint and part of its expanded IP portfolio. They will continue to be sold, supported and leveraged across our expanded base of customers nationwide. |

| ● | Resold specialized ISV applications: The software produced by specialized independent software vendors (“ISV”) is designed to fit a particular vertical market and application. Even still, it must be tailored to meet the needs of each customer and often requires integration to the customer’s enterprise system(s). Depending on the requirements, this tailoring is provided by DecisionPoint under contract with DecisionPoint. |

| ● | DecisionPoint custom development: When one of our off-the-shelf solutions or other ISV solution is not available, custom software can be created in-house using standardized programming platforms like the Microsoft.NET® framework, Java™, Android and Apple iOS. These are used when there is simply no other “off-the-shelf” way to meet the customer’s requirements or when a client believes their business requirements are so unique that only a custom solution will work. An increasingly popular requirement for many corporate clients, which we are able to fulfill, is a custom application that is written once, but supports multiple mobile operating systems. |

Customers

Our customers include large enterprise companies across a wide range of industries including retail, healthcare, transportation and logistics. We had three customers who, together, represented 30% of the Company’s revenue for the year ended December 31, 2023.

No arrangement between us and any customer provide for a minimum amount of products or services that must be purchased by the customer nor require any customer to exclusively utilize us as a provider.

Backlog

At December 31, 2023, our backlog related to product orders that are expected to ship throughout 2024 was approximately $9.2 million.

Competition

The automatic identification and data capture (AIDC) business is one that is highly fragmented and covered by many competitors that range from a one-man shop to multi-billion-dollar companies. DecisionPoint attempts to separate itself from the competition with our expertise and ability to help a customer manage an entire project versus buying a product.

5

The following companies are examples of competitors in the AIDC Industry:

| ● | CDW Corporation – CDW provides thousands of products as a general IT supplier. |

| ● | Denali Advanced Integration – Washington-based Denali Advanced Integration is a full system integration company with services ranging from IT Consulting, Managed Services and Enterprise Mobility Solutions. |

| ● | Other Competitors in the U.S. – Certain ‘catalog and online’ AIDC equipment resellers offer end-users deeply discounted, commodity-oriented products; however, they typically offer limited or no maintenance support beyond the manufacturer’s warranty (which generally results in slower repair turnaround time). More importantly, as end users have become increasingly dependent on value added resellers (“VAR”) and system integrators to provide platform design, integration and maintenance, end users typically do not place major purchase orders with such resellers. |

Suppliers

Products from three suppliers totaled approximately 54% of our cost of sales for the year ended December 31, 2023.

Intellectual Property

We own and maintain a portfolio of intellectual property assets which we hope to continue to build. We believe that our intellectual property assets create great value to us and therefore we take steps to protect those assets.

Employees

As of December 31, 2023, we had a total of approximately 210 full-time employees. We have not experienced any work disruptions or stoppages and we consider relations with our employees to be good.

Legal Proceedings; Product Liability

From time to time, we may be subject to legal proceedings and claims in the ordinary course of business. Currently, we are not a party to any material legal proceedings or subject to any material claims. The results of any future litigation cannot be predicted with certainty, and regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources, and other factors.

Available Information

Our annual and quarterly reports, along with all other reports and amendments filed with or furnished to the SEC, are publicly available free of charge on the Investor Relations section of our website at www.decisionpt.com as soon as reasonably practicable after these materials are filed with or furnished to the SEC. Our corporate governance policies, ethics code and board of directors’ committee charters are posted under the Investor Relations section of the website. We also routinely post important information for investors under the Investor Relations section of our website, including as a means of disclosing material information in compliance with our disclosure obligations under Regulation FD. The information contained on our website is not part of, and is not incorporated by reference in, this Annual Report on Form 10-K or any other report or document we file with or furnish to the SEC. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

6

ITEM 1A. RISK FACTORS

Our operations and financial condition are subject to significant risks, including those described below. This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward looking statements that may be affected by several risk factors, including those set forth below.

RISKS RELATING TO OUR BUSINESS AND INDUSTRY

Our working capital requirements may negatively affect our liquidity and capital resources.

At various times in our history, we have experienced negative working capital and minimal liquidity. If our working capital requirements vary significantly or if our short and long-term working capital needs exceed our cash flows from operations, we would look to our cash balances or other alternative sources of additional outside capital, which may not be available on satisfactory terms and in adequate amounts, if at all.

The mobile computing industry is characterized by rapid technological change, and our success depends upon the frequent enhancement of existing products and services and timely introduction of new products and services that meet our customers’ needs.

Customer requirements for mobile computing products and services are rapidly evolving and technological changes in our industry occur rapidly. To keep up with new customer requirements and distinguish us from our competitors, we must frequently introduce new products and services and enhancements of existing products and services. Enhancing existing products and services and developing new products and services is a complex and uncertain process. It often requires significant investments in research and development (“R&D”), which we do not undertake. Even if we made significant investments in R&D, they might not result in products or services attractive or acceptable to our customers. Furthermore, we may not be able to launch new or improved products or services before our competition launches comparable products or services. Any of these factors could cause our business or results or operations to suffer.

If we fail to continue to introduce new products that achieve broad market acceptance on a timely basis, we will not be able to compete effectively, and we will be unable to increase or maintain sales and profitability. Our future success depends on our ability to develop and introduce new products and product enhancements that achieve broad market acceptance. If we are unable to develop and introduce new products that respond to emerging technological trends and customers’ mission critical needs, our profitability and market share may suffer. The process of developing new technology is complex and uncertain, and if we fail to accurately predict customers’ changing needs and emerging technological trends, our business could be harmed.

We are active in the identification and development of new product and technology services and in enhancing our current products. However, in the enterprise mobility solutions industry, such activities are complex and filled with uncertainty. If we expend a significant amount of resources and our efforts do not lead to the successful introduction of new or improved products, there could be a material adverse effect on our business, profitability, financial condition and market share.

We may also encounter delays in the manufacturing and production of new products from our principal suppliers. Additionally, new products may not be commercially successful. Demand for existing products may decrease upon the announcement of new or improved products. Further, since products under development are often announced before introduction, these announcements may cause customers to delay purchases of any products, even if newly introduced, until the new or improved versions of those products are available. If customer orders decrease or are delayed during the product transition, we may experience a decline in revenue and have excess inventory on hand which could decrease gross profit margins. Our profitability might decrease if customers, who may otherwise choose to purchase existing products, instead choose to purchase lower priced models of new products. Delays or deficiencies in the development, manufacturing, and delivery of, or demand for, new or improved products could have a negative effect on our business or profitability.

Our products are highly technical and may contain undetected errors, product defects, security vulnerabilities, or software errors.

Our products, including our software products, are highly technical and complex and, when deployed, may contain errors, defects, or security vulnerabilities, especially when first introduced or when new models or versions are released. Such occurrences could result in damage to our reputation, lost revenue, diverted development resources, increased customer service and support costs, warranty claims, and litigation.

We warrant that our products will be free of defect for various periods of time, depending on the product. In addition, certain of our contracts include epidemic failure clauses. If invoked, these clauses may entitle the customer to return or obtain credits for products and inventory, or to cancel outstanding purchase orders even if the products themselves are not defective.

7

Errors, viruses, or bugs may be present in software or hardware that we acquire or license from third parties and incorporate into our products or in third-party software or hardware that our customers use in conjunction with our products. Our customers’ proprietary software and network firewall protections may corrupt data from our products and create difficulties in implementing our solutions. Changes to third-party software or hardware that our customers use in conjunction with our software could also render our applications inoperable. Any errors, defects, or security vulnerabilities in our products or any defects in, or compatibility issues with, any third-party hardware or software or customers’ network environments discovered after commercial release could result in loss of revenue or delay in revenue recognition, loss of customers, theft of trade secrets, data or intellectual property and increased service and warranty cost, any of which could adversely affect our business, financial condition, and results of operations.

Undiscovered vulnerabilities in our products alone or in combination with third-party hardware or software could expose them to hackers or other unscrupulous third parties who develop and deploy viruses and other malicious software programs that could attack our products. Actual or perceived security vulnerabilities in our products could harm our reputation and lead some customers to return products, to reduce or delay future purchases, or use competitive products.

We face competition from numerous sources and competition may increase, leading to a decline in revenues.

We compete primarily with well-established companies, many of which we believe have greater resources than us. We believe that barriers to entry are not significant and start-up costs are relatively low, so our competition may increase in the future. New competitors may be able to launch new businesses similar to ours, and current competitors may replicate our business model, at a relatively low cost. If competitors with significantly greater resources than ours decide to replicate our business model, they may be able to quickly gain recognition and acceptance of their business methods and products through marketing and promotion. We may not have the resources to compete effectively with current or future competitors. If we are unable to effectively compete, we will lose sales to our competitors and our revenues will decline.

Our competitors may be able to develop their business strategy and grow revenue at a faster pace than us, which would limit our results of operations and may force us to cease or curtail operations.

The wireless mobile solutions marketplace, while highly fragmented, is very competitive and many of our competitors are more established and have greater resources. We expect that competition will intensify in the future. Some of these competitors also have greater market presence, marketing capabilities, technological and personnel resources than the Company. As compared with our company therefore, such competitors may:

| ● | develop and expand their infrastructure and service/product offerings more efficiently or more quickly; | |

| ● | adapt more swiftly to new or emerging technologies and changes in client requirements; | |

| ● | take advantage of acquisition and other opportunities more effectively; | |

| ● | devote greater resources to the marketing and sale of their products and services; and | |

| ● | leverage more effectively existing relationships with customers and strategic partners or exploit better recognized brand names to market and sell their services. |

These current and prospective competitors include other wireless mobility solutions companies, hardware suppliers and in house IT departments.

8

A significant portion of our revenue is dependent upon a small number of customers, and the loss of any one or more of these customers would negatively impact our results of operations.

We had three customers who, together, represented 30% of the Company’s revenue for the year ended December 31, 2023.

Customer mix shifts significantly from year to year, but a concentration of the business with a few large customers is typical in any given year. A decline in our revenues could occur if a customer which has been a significant factor in one financial reporting period gives us significantly less business in the following period. Any one of our customers could reduce their orders for our products and services in favor of a more competitive price or different product at any time. The loss of a significant customer could have a material adverse impact on our Company.

Our contracts with these customers and our other customers do not include any specific purchase requirements or other requirements outside of the normal course of business. The majority of our customer contracts are on an annual basis for service support while on a purchase order basis for hardware purchases. Typical hardware sales are submitted on an estimated order basis with subsequent follow-on orders for specific quantities. These sales are ultimately subject to the time that the units are installed at all of the customer locations as per their requirements. Termination provisions are generally standard clauses based upon non-performance. General industry standards for contracts provide ordinary terms and conditions, while actual work and performance aspects are usually dictated by a Statement of Work which outlines what is being ordered, product specifications, delivery, installation and pricing.

If wireless carriers were to terminate or materially reduce their business relationships with us, our operating results would be materially harmed.

We have established key wireless carrier relationships with T-Mobile and Verizon. We have an informal arrangement with these carriers pursuant to which they provide us referrals of end users interested in field mobility solutions, and we, in turn, provide solutions which require cellular data networks. We do not have any binding agreements with these carriers. If these carriers were to terminate or materially reduce, for any reason, their business relationships with us, our operating results would be materially harmed.

Use of third-party suppliers and service providers could adversely affect our product quality, delivery schedules or customer satisfaction, any of which could have an adverse effect on our financial results.

In particular, we rely heavily on a number of privileged vendor relationships as a value-added reseller (“VAR”) for the Motorola Solutions Partner Pinnacle Club program, a manufacturer of bar code scanners and portable data terminals; as an Honors Solutions Provider for Intermec, a manufacturer of bar code scanners and terminals; as a Premier Partner with Zebra, a printer manufacturer, and O’Neil, the leading provider of ‘ruggedized’ handheld mobile printers. The loss of VAR status with any of these manufacturers could have a substantial adverse effect on our business. Our ability to meet financial objectives depends on our ability to timely obtain an adequate delivery of hardware as well as services from our vendors. Certain supplies are available from a single source or limited sources for which we may be unable to provide suitable alternatives in a timely manner. In addition, we may experience increases in vendor prices that could have a negative impact on our business. Credit constraints by our vendors could cause us to accelerate payables by us, impacting our cash flow. Any unanticipated expense, or disruption in our business or operations relating a limited number of suppliers could adversely affect our business, financial condition and results of operations.

Growth of, and changes in, our revenues and profits depend on the customer, product and geographic mix of our sales. Fluctuations in our sales mix could have an adverse impact on or increase the volatility of our revenues, gross margins and profits.

Sales of our products to large enterprises tend to have lower prices and gross margins than sales to smaller firms. In addition, our gross margins vary depending on the product or service delivered. Growth in our revenues and gross margins therefore depends on the customer, product and geographic mix of our sales. If we are unable to execute a sales strategy that results in a favorable sales mix, our revenues, gross margins and earnings may decline. Further, changes in the mix of our sales from quarter-to-quarter or year-to-year may make our revenues, gross margins and earnings more volatile and difficult to predict.

9

Our sales cycles can be long, unpredictable and require considerable time and expense, which may cause our operating results to fluctuate.

Our sales cycle, which is the time between initial contact with a potential customer and the ultimate sale, is often lengthy and unpredictable. Some of our potential customers may already have partial managed mobility solutions in place under fixed-term contracts, which may limit their ability to commit to purchase our solution in a timely fashion. In addition, our potential customers typically undertake a significant evaluation process that can last up to a year or more, and which requires us to expend substantial time, effort and money educating them about the capabilities of our offerings and the potential cost savings they can bring to an organization. Furthermore, the purchase of our products and services may require coordination and agreement across many departments within a potential customer’s organization, which further contributes to our lengthy sales cycle. As a result, we have limited ability to forecast the timing and size of specific sales. Any delay in completing, or failure to complete, sales in a particular quarter or year could harm our business and could cause our operating results to vary significantly.

Our revolving line-of-credit agreement and our loan agreements may limit our flexibility in managing our business, and defaults of any financial and non-financial covenants in these agreements could adversely affect us.

Our revolving-line-of-credit agreement as well as our term loan impose operating restrictions on us in the form of financial and non-financial covenants. These restrictions may limit the manner in which we can conduct our business and may restrict us from engaging in favorable business opportunities.

If we incur debt in future periods, our indebtedness may adversely affect our cash flow and our ability to operate our business.

As of December 31, 2023, we had availability under a line of credit of $8.7 million. Our current line of credit expires in July 2026. Our level of indebtedness relative to stockholders’ equity could have important consequences to you, including with respect to our ability to declare and pay a dividend, and significant effects on our business, including the following:

| ● | certain of our debt obligations are secured by significant Company assets; | |

| ● | our ability to obtain additional financing for working capital, capital expenditures, strategic acquisitions or general corporate purposes may be impaired; | |

| ● | we could be at a competitive disadvantage compared to our competitors that may have proportionately less debt; | |

| ● | our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate may be limited; | |

| ● | our ability to fund a change of control offer may be limited; and | |

| ● | we may be more vulnerable to economic downturns and adverse developments in our business. |

We expect to obtain the funds to pay our day-to-day expenses and to repay our indebtedness primarily from our operations. Our ability to meet our expenses and make these payments therefore depends on our future performance, which will be affected by financial, business, economic and other factors, many of which we cannot control. Our business may not generate sufficient cash flow from operations in the future, and our currently anticipated growth in sales and cash flow may not be realized, either or both of which could result in our being unable to repay indebtedness, including the outstanding promissory notes, or to fund other liquidity needs. If we do not have enough funds, we may be in breach our debt covenants and/or be required to refinance all or part of our then existing debt, sell assets or borrow more funds, which we may not be able to accomplish on terms favorable to us, or at all. In addition, the terms of existing or future debt agreements may restrict us from pursuing any of these alternatives.

10

Our sales and profitability may be affected by changes in macro-economic, business or industry conditions.

If the economic climate in the U.S. or abroad deteriorates as a result of global conflicts in Europe (or elsewhere), rising interest rates, or otherwise, customers or potential customers could reduce or delay their technology investments. Reduced or delayed technology investments could decrease our sales and profitability. In this environment, our customers may experience financial difficulty, cease operations and fail to budget or reduce budgets for the purchase of our products and services. This may lead to longer sales cycles, delays in purchase decisions, payment and collection, and can also result in downward price pressures, causing our sales and profitability to decline. In addition, general economic uncertainty and volatility arising from geopolitical events and concerns, inflation, rises in energy prices, changes in interest rates and general declines in capital spending in the information technology sector make it difficult to predict changes in the purchasing requirements of our customers and the markets we serve. There are many other factors which could affect our business, including:

| ● | the introduction and market acceptance of new technologies, products and services; | |

| ● | new competitors and new forms of competition; | |

| ● | the size and timing of customer orders; | |

| ● | the size and timing of capital expenditures by our customers; | |

| ● | adverse changes in the credit quality of our customers and suppliers; | |

| ● | changes in the pricing policies of, or the introduction of, new products and services by us or our competitors; | |

| ● | changes in the terms of our contracts with our customers or suppliers; | |

| ● | the availability of products from our suppliers; and | |

| ● | variations in product costs and the mix of products sold. |

These trends and factors could adversely affect our business, profitability and financial condition and diminish our ability to achieve our strategic objectives.

We may be unable to protect our proprietary software and methodology.

Our success depends, in part, upon our proprietary software, methodology and other intellectual property rights. We rely upon a combination of trade secrets, nondisclosure and other contractual arrangements, and copyright and trademark laws to protect our proprietary rights. We generally enter into nondisclosure and confidentiality agreements with our employees, partners, consultants, independent sales agents and customers, and limit access to and distribution of our proprietary information. We cannot be certain that the steps we take in this regard will be adequate to deter misappropriation of our proprietary information or that we will be able to detect unauthorized use and take appropriate steps to enforce our intellectual property rights. We have attempted to put in place certain safeguards in our policies and procedures to protect intellectual property developed by employees. Our policies and procedures stipulate that intellectual property created by employees and its consultants remain our property. If we are unable to protect our proprietary software and methodology, the value of our business may decrease, and we may face increased competition.

We have not sought to protect our proprietary knowledge through patents and, as a result, our sales and profitability could be adversely affected to the extent that competing products/services were to capture a significant portion of our target markets.

We have generally not sought patent protection for our products and services, relying instead on our technical know-how and ability to design solutions tailored to our customers’ needs. Our sales and profitability could be adversely affected to the extent that competing products/services were to capture a significant portion of our target markets. To remain competitive, we must continually improve our existing personnel skill sets and capabilities and the provision of the services related thereto. Our success will also depend, in part, on management’s ability to recognize new technologies and services and make arrangements to license in or acquire such technologies so as to always be at the leading edge.

11

Assertions by a third party that our software products or technology infringes its intellectual property, whether or not correct, could subject us to costly and time-consuming litigation or expensive licenses.

Although we believe that our services and products do not infringe on the intellectual property rights of others, infringement claims may be asserted against us in the future. There is frequent litigation in the communications and technology industries based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition, the possibility of intellectual property rights claims against us may increase. These claims, whether or not successful, could:

| ● | divert management’s attention; | |

| ● | in costly and time-consuming litigation; | |

| ● | require us to enter into royalty or licensing agreements, which may not be available on acceptable terms, or at all; or | |

| ● | require us to redesign our software products to avoid infringement. |

As a result, any third-party intellectual property claims against us could increase our expenses and impair our business. In addition, although we have licensed proprietary technology, we cannot be certain that the owners’ rights in such technology will not be challenged, invalidated or circumvented. Furthermore, many of our customer agreements require us to indemnify our customers for certain third-party intellectual property infringement claims, which could increase our costs as a result of defending such claims and may require that we pay damages if there were an adverse ruling related to any such claims. These types of claims could harm our relationships with our customers, may deter future customers from purchasing our software products or could expose us to litigation for these claims. Even if we are not a party to any litigation between a customer and a third party, an adverse outcome in any such litigation could make it more difficult for us to defend our intellectual property in any subsequent litigation in which we are a named party.

We are dependent on information technology systems and infrastructure (cybersecurity).

We rely upon technology systems and infrastructure. Our technology systems are potentially vulnerable to breakdown or other interruption by fire, power loss, system malfunction, unauthorized access and other events such as computer hackings, cyber-attacks, computer viruses, worms or other destructive or disruptive software. Likewise, data privacy breaches by employees and others with permitted access to our systems may pose a risk that sensitive data may be exposed to unauthorized persons or to the public. While we have invested heavily in the protection of data and information technology and in related training, there can be no assurance that our efforts will prevent significant breakdowns, breaches in our systems or other cyber incidents that could have a material adverse effect upon our reputation, business, operations or financial condition of the Company. In addition, significant implementation issues may arise as we continue to consolidate and outsource certain computer operations and application support activities.

We are subject to evolving privacy laws in the United States and other jurisdictions that are subject to potentially differing interpretations and which could adversely impact our business and require that we incur substantial costs.

Existing privacy-related laws and regulations in the United States and other countries are evolving and are subject to potentially differing interpretations, and various U.S. federal and state or other international legislative and regulatory bodies may expand or enact laws regarding privacy and data security-related matters. In addition, the California Consumer Privacy Act (the “CCPA”), which took effect in January 2020, was amended by the California Privacy Rights Act (“the “CPRA”) and took full effect in January 2023. The CCPA and CPRA, among other things, gives California residents expanded rights to access and delete their personal information, opt out of certain personal information sharing, and receive detailed information about how their personal information is used. Other U.S. states and the U.S. Congress have introduced, and some states like Virginia and Colorado have enacted in 2021, data privacy legislation, which may impact our business. Data privacy legislation, amendments and revisions to existing data privacy legislation, and other developments impacting data privacy and data protection may require us to modify our data processing.

We may need to raise additional funds, and these funds may not be available when we need them or may not be obtainable on favorable terms.

We may need to raise additional funds in order to fund our growth strategy and fully implement our business plan. Specifically, we may need to raise additional funds in order to pursue rapid expansion, develop new or enhanced services and products, and acquire complementary businesses or assets. Additionally, we may need funds to respond to unanticipated events that require us to make additional investments in or expenditures on behalf of our business. There can be no assurance that additional financing will be available when needed, on favorable terms, or at all. If funds are not available when we need them, then we may need to change our business strategy, reduce our rate of growth or suffer losses or other adverse impacts.

12

If we incur operating losses or do not raise sufficient additional capital, material adverse events may occur, including, but not limited to: 1) a reduction in the nature and scope of our operations, 2) our inability to fully implement our current business plan, and 3) defaults under our existing loan agreements. A covenant default would give one of our creditors the right to demand immediate payment of all outstanding amounts, which we would likely not be able to pay out of normal operations. There are no assurances that we can successfully implement our plans with respect to these liquidity matters.

Our inability to successfully implement our acquisition strategy could have a material adverse effect on our business.

We have grown in part as a result of our various acquisitions, including the acquisitions of Advanced Mobile Group, LLC, and Macro Integration Systems, Inc., and we anticipate continuing to grow in this manner. Although we expect to regularly consider additional strategic transactions in the future, we may not identify suitable opportunities or, if we do identify prospects, it may not be possible to consummate a transaction on acceptable terms. Antitrust or other competition laws may also limit our ability to acquire or work collaboratively with certain businesses or to fully realize the benefits of a prospective acquisition. Furthermore, a significant change in our business or the economy, an unexpected decrease in our cash flows or any restrictions imposed by our indebtedness may limit our ability to obtain the necessary capital or otherwise impede our ability to complete a transaction. Regularly considering strategic transactions can also divert management’s attention and lead to significant due diligence and other expenses regardless of whether we pursue or consummate any transaction. Failure to identify suitable transaction partners and to consummate transactions on acceptable terms, as well as the commitment of time and resources in connection with such transactions, could have a material adverse effect on our business, financial condition and results of operations.

Any failure to realize the anticipated benefits of an acquisition, including unanticipated expenses and liabilities related to acquisitions, could have a material adverse effect on our business.

We pursue each acquisition with the expectation that the transaction will result in various benefits, including growth opportunities and synergies from increased efficiencies. However, even if we are able to successfully integrate an acquired business, we may not realize some or all of the anticipated benefits within the anticipated timeframes or at all. Furthermore, we may experience increased competition that limits our ability to expand our business, we may not be able to capitalize on expected business opportunities, and general industry and business conditions may deteriorate. Acquisitions also expose us to significant risks and costs, and business and operational overlaps may lead to hidden costs. These costs can include unforeseen pre-acquisition liabilities or the impairment of customer relationships or acquired assets, such as goodwill. We may also incur costs and inefficiencies to the extent an acquisition expands the industries, markets or geographies in which we operate due to our limited exposure to and experience in a given industry, market or region. Acquisitions at times involve post-transaction disputes with the counterparty regarding a number of matters, including disagreements over the amount of a purchase price or other working capital adjustment or disputes regarding whether certain liabilities are covered by the indemnification provisions of the transaction agreement. We may underestimate the level of certain costs or the exposure we may face as a result of acquired liabilities. If any of these or other factors limit our ability to achieve the anticipated benefits of a transaction, or we encounter other unexpected transaction-related costs and liabilities, our business, financial condition and results of operations could be materially and adversely affected.

Future business combinations and acquisition transactions, if any, as well as recently closed business combinations and acquisition transactions, may not succeed in generating the intended benefits and may adversely affect our business.

Part of our growth strategy is to evaluate strategic acquisitions or relationships from time to time. The inability of our management to successfully integrate acquired businesses or technologies, and any related diversion of management’s attention, could have a material adverse effect on our business, operating results and financial condition.

Business combinations and other acquisition transactions may have a direct adverse effect on our financial condition, results of operations, liquidity or stock price. To complete acquisitions or other business combinations, we may have to use cash, issue new equity securities with dilutive effects on existing stockholders, take on new debt, assume contingent liabilities or amortize assets or expenses in a manner that might have a material adverse effect on our balance sheet, results of operations or liquidity. We are required to record business combination-related costs and other items as current period expenses, which would have the effect of reducing our reported earnings in the period in which an acquisition is consummated. These and other potential negative effects of an acquisition transaction could prevent us from realizing the benefits of such transaction and have a material adverse impact on our stock price, financial condition, results of operations and liquidity.

13

We must effectively manage the structure and size of our operations, or our company will suffer.

Our ability to successfully continue to implement our business plan requires an effective planning and management process. If funding is available, we intend to continue to attempt to increase the scope of our operations and acquire complementary businesses or assets. Implementing our business plan will require significant additional funding and resources. If we successfully grow our operations, we will need to hire additional employees and make significant capital investments. If we grow our operations, it will place a significant strain on our existing management and resources. If we grow, we will need to improve our financial and managerial controls and reporting systems and procedures, and we will need to expand, train and manage our workforce. If we need to reduce the size of our infrastructure, we may need to do it swiftly. Any failure to manage any of the foregoing areas efficiently and effectively would cause our business to suffer.

We are heavily dependent on our senior management, and a loss of a member of our senior management team could cause our stock price to decline.

If we lose members of our senior management, we may not be able to find appropriate replacements on a timely basis, and our business and value of our common stock could be adversely affected. Our existing operations and continued future development depend to a significant extent upon the performance and active participation of certain key individuals, including our Chief Executive Officer, our Senior Vice Presidents and certain other senior management individuals. We cannot guarantee that we will be successful in retaining the services of these or other key personnel. If we were to lose any of these individuals, we may not be able to find appropriate replacements on a timely basis and our financial condition and results of operations could be materially adversely affected.

Our inability to hire, train and retain qualified employees could cause our financial condition to weaken.

The success of our business is highly dependent upon our ability to hire, train and retain qualified employees. We face competition from other employers for people, and the availability of qualified people is limited. We must offer a competitive employment package in order to hire and retain employees, and any increase in competition for people may require us to increase wages or benefits in order to maintain a sufficient workforce, resulting in higher operation costs. Additionally, we must successfully train our employees in order to provide high quality services. In the event of high turnover or shortage of people, we may experience difficulty in providing consistent high-quality services. These factors could adversely affect our results of operations.

If our goodwill or amortizable intangible assets become impaired, we may be required to record a significant charge to earnings.

We review our goodwill and amortizable intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is required to be evaluated for impairment at least annually. Factors that may be considered a change in circumstances indicating that the carrying value of our goodwill or amortizable intangible assets may not be recoverable include a decline in stock price and market capitalization, decrease in estimated future cash flows, and slower growth rates in our industry. We may be required to record a significant charge to earnings in our financial statements during the period in which any impairment of our goodwill or amortizable intangible assets is determined, resulting in a material adverse impact on our results of operations.

RISKS RELATING TO OUR SECURITIES

Despite our listing on the NYSE American, there can be no assurance that an active trading market for our common stock will be sustained, and the NYSE American may subsequently delist our common stock if we fail to comply with ongoing listing standards.

In May 2022, our common stock commenced trading on the NYSE American under the symbol “DPSI.” The NYSE American’s rules for listed companies require us to meet certain financial, public float, bid price and liquidity standards on an ongoing basis in order to continue the listing of our common stock. To satisfy the initial listing standards for the NYSE American, we had to execute a reverse stock split. In addition to specific listing and maintenance standards, the NYSE American has broad discretionary authority over the continued listing of securities, which it could exercise with respect to the listing of our common stock.

14

If we fail to meet those standards, as applied by NYSE American in its discretion, our common stock may be subject to delisting. We intend to take all commercially reasonable actions to maintain our NYSE American listing. If our common stock is delisted in the future, it is not likely that we will be able to list our common stock on another national securities exchange and, as a result, we expect our securities would be quoted on an over-the-counter market; however, if this were to occur, our stockholders could face significant material adverse consequences, including limited availability of market quotations for our common stock and reduced liquidity for the trading of our securities. In addition, in the event of such delisting, we could experience a decreased ability to issue additional securities and obtain additional financing in the future.

The National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the sale of certain securities, which are referred to as “covered securities.” Because our common stock is listed on NYSE American, shares of our common stock qualify as covered securities under the statute. Although the states are preempted from regulating the sale of our securities, the federal statute does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case. Further, if we were no longer listed on NYSE American, our securities would not qualify as covered securities under the statute, and we would be subject to regulation in each state in which we offer our securities.

Further, there can be no assurance that an active trading market for our common stock will be sustained despite our listing on the NYSE American.

The market price for our common stock may be volatile, and your investment in our common stock could decline in value.

The market price of our common stock could fluctuate significantly in response to various factors and events, including:

| ● | the lack of an established trading market for our common stock; | |

| ● | our ability to integrate operations, technology, products and services; | |

| ● | our ability to execute on our business plan; | |

| ● | operating results below expectations; | |

| ● | our issuance of additional securities, including debt or equity or a combination thereof, which may be necessary to fund our operating expenses; | |

| ● | announcements of technological innovations or new products by us or our competitors; | |

| ● | the loss of any strategic relationship; | |

| ● | economic and other external factors; | |

| ● | period-to-period fluctuations in our financial results; and | |

| ● | whether an active trading market in our common stock is maintained. |

In addition, the securities markets have from time-to-time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

In the past, securities class action litigation has often been brought against companies that experience volatility in the market price of their securities. Whether or not meritorious, litigation brought against us could result in substantial costs and a diversion of management’s attention and resources, which could adversely affect our business, operating results and financial condition.

15

We expect that our quarterly results of operations will fluctuate, and this fluctuation could cause our stock price to decline.

Our quarterly operating results are likely to fluctuate in the future. These fluctuations could cause our stock price to decline. The nature of our business involves variable factors which could cause our operating results to fluctuate.

Due to the possibility of fluctuations in our revenues and expenses, we believe that quarter-to-quarter comparisons of our operating results at times are not a good indication of our future performance.

If we or our existing stockholders sell a substantial number of shares of our common stock in the public market our stock price may decline even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market, or the perception in the market that the holders of a large number of shares intend to sell shares (particularly with respect to our affiliates, directors, executive officers or other insiders), could depress the market price of our common stock and could impair our future ability to obtain capital, especially through an offering of equity securities. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and sellers remain willing to sell the shares.

In the future, we may issue additional shares to our employees, directors or consultants, under our equity compensation plan, in connection with corporate alliances or acquisitions, or to raise capital. Due to these factors, sales of a substantial number of shares of our common stock in the public market could occur at any time.

If securities analysts do not publish research or publish unfavorable research about our business, our stock price and trading volume could decline.

The trading market for a company’s common stock often is based in part on the research and reports that securities and industry analysts publish about the company. We are not currently aware of any well-known analysts that are covering our common stock, and without analyst coverage it could be hard to generate interest in investments in our common stock. Furthermore, if analyst coverage does develop, and an analyst downgrades our stock or publishes unfavorable research about our business, or if our clinical trials or operating results fail to meet the analysts’ expectations, our stock price would likely decline.

We do not anticipate paying dividends on our common stock.

We have never declared or paid cash dividends on our common stock and do not expect to do so in the foreseeable future. The declaration of dividends is subject to the discretion of our board of directors and will depend on various factors, including our operating results, financial condition, future prospects, covenants in documents governing our debt obligations and any other factors deemed relevant by our board of directors. You should not rely on an investment in our company if you require dividend income from your investment in our company. The success of your investment will likely depend entirely upon any future appreciation of the market price of our common stock, which is uncertain and unpredictable. There is no guarantee that our common stock will appreciate in value.

Anti-takeover provisions in our charter documents and Delaware law, could discourage, delay, or prevent a change in control of our company and may affect the trading price of our common stock.

We are a Delaware corporation and the anti-takeover provisions of the Delaware General Corporation Law may discourage, delay, or prevent a change in control by prohibiting us from engaging in a business combination with an interested stockholder for a period of three years after the person becomes an interested stockholder, even if a change in control would be beneficial to our existing stockholders.

16

Our Amended and Restated Certificate of Incorporation, as amended (the “Charter”), and our Amended and Restated Bylaws (the “Bylaws”) may discourage, delay, or prevent a change in our management or control over us that stockholders may consider favorable. Our Charter and Bylaws:

| ● | provide that vacancies on our board of directors, including newly created directorships, may be filled only by a majority vote of directors then in office; | |

| ● | do not provide stockholders with the ability to cumulate their votes; and | |

| ● | require advance notification of stockholder nominations and proposals. |

In addition, our Charter permits the Board to issue up to 10 million shares of preferred stock with such powers, rights, terms and conditions as may be designated by the Board upon the issuance of shares of preferred stock at one or more times in the future. Specifically, the Charter permits the Board to approve the future issuance of all or any shares of the preferred stock in one or more series, to determine the number of shares constituting any series and to determine any voting powers, conversion rights, dividend rights, and other designations, preferences, limitations, restrictions and rights relating to such shares without any further authorization by our stockholders. The Board’s power to issue preferred stock could have the effect of delaying, deterring or preventing a transaction or a change in control of our company that might otherwise be in the best interest of our stockholders.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 1C. CYBERSECURITY

We take a comprehensive approach to managing cybersecurity risk, starting with the integration of cybersecurity risk into our overall enterprise risk management framework, among other significant risks to the Company.

Board Oversight

Our Board of Directors holds the ultimate responsibility for overseeing risks to the Company. To support this governance, a Steering Committee, composed of members of management, including our Director of IT and certain members of the Board, assists with the specific focus on cybersecurity risks. Management provides the Board with comprehensive cybersecurity updates at least annually.

The Steering Committee thoroughly monitors the quality and effectiveness of the Company’s cybersecurity program. This encompasses the security of our internal information technology systems, products, and solutions, as well as our cyber incident response plan and resources. To stay informed, the Steering Committee receives regular updates from management on cybersecurity initiatives. These updates cover prevention, detection, mitigation, and remediation of cyber threats, along with the overall health of the Company’s cybersecurity program, results of third-party assessments, and the latest cyber threat trends. Additionally, the Steering Committee reviews the Company’s cybersecurity policies and methodologies to ensure continual service improvements. This demonstrates a company commitment to not only maintaining the existing cybersecurity framework but also proactively identifying and implementing enhancements.

Management’s Role and Experience

Our Director of IT, along with other members of management are responsible for day-to-day cyber risk management activities, including proactively identifying, assessing, prioritizing, managing and mitigating enterprise cybersecurity risks.

This encompasses several key functions:

| ● | Risk Identification and Assessment: Management must work to continuously identify potential cyber threats and vulnerabilities across the organization’s systems, networks, and data. Regular assessments analyze the likelihood and potential impact of these threats. |

| ● | Prioritization and Response: Based on assessments, management must prioritize risk mitigation efforts, allocating resources effectively. This includes developing strategies to counter or reduce high-priority risks and implementing appropriate security controls. |

| ● | Oversight and Implementation: Management oversees the implementation and enforcement of cybersecurity policies, procedures, and technical safeguards. This requires clear communication to employees and ongoing monitoring of compliance. |

| ● | Incident Response Planning: Having a comprehensive and well-rehearsed incident response plan is crucial to minimize damage during a breach. Management plays a vital role in developing this plan, training personnel, and guiding the response when needed. |

17

| ● | Employee Education and Awareness: Management establishes a cybersecurity-aware culture within the organization. This is done through regular training, awareness campaigns, and promoting a sense of shared responsibility for security. |

| ● | Vendor Management: Third-party vendors can introduce risks. Management must ensure vendors adhere to the Company’s cybersecurity standards and assess their security practices throughout the partnership. |

Our Director of IT is the senior-most security professional responsible for the implementation of the Company’s cybersecurity, product security, and corporate/physical security programs, and reports to the Senior Vice President of Managed Services. He has over 20 years of cybersecurity experience.

Cybersecurity Risk Management

The underlying controls of our cyber risk management program are based on recognized best practices and standards for cyber security and information technology, including the National Institute of Standards and Technology Cybersecurity Framework. Our approach to cybersecurity risk management includes the following key elements:

| ● | Endpoint Protection: Antivirus and Endpoint Detection and Response (EDR) solutions are deployed on all company computer assets, combined with Remote Endpoint Management for centralized monitoring and control. |